Regional Transportation Finance

Introduction

This chapter examines and describes the region’s revenue sources and funding expected to be available to complete the 2050 Transportation Policy Plan projects and programs to achieve the region’s transportation vision. Recent actions taken by both the State of Minnesota and the federal government have increased the availability of and access to transportation revenues, presenting a significantly different financial outlook than anticipated in past plans. The region’s current financial outlook and plan offer a level of revenue availability, investment, and financial stability – particularly for transit, bicycle, and pedestrian investment – that was not available under past transportation finance plans.

In 2023, the Minnesota Legislature provided increases in traditional sources of regional transportation funding including the gas tax, vehicle registration tax, motor vehicle sales tax, and state general funds dedicated to transportation. They also included new transportation revenue sources, most notably a new regional sales tax for transit, active transportation (walking, biking, rolling), and county transportation. In addition, local governments received a new statewide delivery fee, along with dedicated taxes from the sales of auto repair parts for transportation investment.

The 2021 federal Infrastructure Investment and Jobs Act (IIJA), also referred to as the Bipartisan Infrastructure Law (BIL), increased the traditional federal formula funding programs for highways and transit along with creating new competitive funding programs. Many of the new federal competitive programs address goals such as safety, community connectivity, climate change, resiliency, and multimodal investments that lacked specific funding programs under previous federal acts.

Given how recently these significant changes occurred, it is essential to continue leveraging regional partnerships, planning, and coordination to assure that these funds are best directed to benefit communities throughout the region and move the region toward accomplishing our shared vision and goals.

Fiscal outlook

Fiscal constraint

Under federal law, long-range transportation plans must be “fiscally constrained.” Fiscal constraint means that the plan identifies all transportation revenues that can reasonably be expected and are assumed to be available within the plan’s time frame, together with the proposed spending of those revenues. Past regional plans also included transportation spending needs beyond what could be accomplished within fiscal constraint. In the 2040 Transportation Policy Plan, this unfunded need was called the increased revenue scenario. Transportation programs and projects identified in the increased revenue scenario helped demonstrate what could be accomplished with higher levels of transportation revenue and spending. It also helped urge policymakers to identify and approve new funding for transportation to achieve those outcomes.

The recent state and federal funding increases do not fund or meet all regional transportation needs, but these increases will go a long way toward accomplishing previously identified unfunded needs and project funding gaps. As agencies implement new sources of revenue, and as officials make related shorter-term policy and spending decisions, the region will gain a better understanding of where overall funding needs persist.

Because of the many recent increases and changes in transportation funding, this plan assumes that no additional significant policy or law changes will take place to increase state and federal transportation funding to the region over the next few years. This plan describes one fiscally constrained revenue and spending scenario and no longer contains an increased revenue scenario. However, many new and increased competitive funding opportunities are available at both the federal and state levels that may result in additional regional transportation revenues and projects. As competitive funding is secured for regionally significant projects (such as transit capital investment grants for transitways), the projects and funding will be amended into the fiscally constrained plan. The plan also identifies the level of increased, but as yet unallocated, funding now available and opportunities provided for new transportation investment, particularly for those investments and projects that align with the regional goals of addressing climate change, safety, and equity.

These investment opportunities could receive funding as decisions are made about distributing the new and increased revenues from 2023 legislation or may remain as unfunded needs. This plan will be updated in five years and will show a clearer vision as to how the new revenues are being distributed and used, progress towards outcomes, and remaining areas of transportation investment need. In addition, as policymakers make decisions about new funding allocation and investing in regionally significant projects, these will be amended into the regional plan.

Revenue and spending structure

The revenue and spending sections of this chapter describe revenue sources, current generation rates, inflationary assumptions, and financial risks with each transportation funding source expected to be available to the region. The revenues and spending within this plan are described in four distinct revenue and spending categories:

- MnDOT metro state highway revenues and spending include all revenues allocated to MnDOT’s metro district for capital and operating spending on the state highway system owned and operated by MnDOT in the metropolitan area.

- Regional transit revenues and spending include all revenues and spending on the regional transit system by all regional transit providers, counties, and other local governments for regional bus and transitway capital and operations.

- Local government transportation revenues and spending include all revenues and spending by metropolitan area counties, cities, and townships on their local transportation system including roadways owned by the local entities and the local bicycle and pedestrian system.

- Regionally allocated revenues include all funds allocated to the Metropolitan Council as the region’s metropolitan planning organization (MPO) and its Transportation Advisory Board (TAB). These revenues are allocated by the Met Council and TAB for expenditure on metro-area state highways, regional transit, and for local transportation purposes.

Figure 3.1: Revenue and spending categories

Federal formula funds designated to the Met Council as the Twin Cities region’s designated MPO are one regional source of “flexible” funding that can be used across transportation types and purposes. The Met Council, in strong partnership with TAB, allocates these federally designated funds through the Regional Solicitation across the full scope of transportation types and purposes. In addition, 2023 state transportation legislation provided new regional sales tax funds for TAB to distribute for active transportation (walking, biking, and rolling). The focus and distribution methods for both these sources of funding will be determined through the Regional Solicitation evaluation being conducted throughout 2024-2025. The results of the solicitation evaluation will be amended into this plan upon its completion.

The high-level summary of revenue and spending for each of the categories is contained within this chapter, while the specific investment direction and projects for the highways, transit, bicycle, and pedestrian systems are shown in the specific investment chapters. Local transportation projects that can be accomplished with existing revenues are identified by each county, city, and township within their individual decision-making processes, and are documented in adopted local plans and budgets. Regionally significant local projects that are identified for implementation by local governments are noted in the project list in the plan’s appendices.

Transportation Revenues 2025-2050

Table 3.1 shows the total regional transportation revenues, estimated at $4.7 billion in calendar year 2025, and $171 billion expected to be available over the 26-year period of this plan, 2025-2050. This amount compares to the $93 billion expected over the 26-year period of the region’s previously adopted plan for 2015-2040. This significant increase can be attributed to new transportation revenue sources and general funds, to state and local tax rate increases, and also the inflationary growth impacts of extending the regional plan a decade into the future.

| Category | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| MnDOT metro state highways | $800 | 17% | $32,700 | 19% |

| Regional transit | $1,650 | 36% | $53,950 | 32% |

| Local government transportation | $2,050 | 44% | $80,150 | 47% |

| Regionally allocated revenues | $150 | 3% | $4,050 | 2% |

| Total regional transportation revenue | $4.7 billion | 100% | $171 billion | 100% |

Figure 3.2 Regionally allocated revenues

Across the life of this plan, about $3.1 billion of flexible federal funding is expected to be allocated through the Regional Solicitation, representing around 2% of the transportation funds that will be spent within the region. In addition, the 5% of the regional transportation sales and use tax provided by the 2023 legislature offers significant new revenue for the Transportation Advisory Board to spend on regional support for walking, biking, and rolling. From 2025 to 2050 the regional active transportation (walking, biking, and rolling) funds will total almost $1 billion.

Together, the regional federal funds and regional active transportation funds total $4 billion, or 2.4% of the region’s total transportation funds.

It is important to note that due to constitutional dedications, and specific federal and state allocation formulas, the vast majority of the transportation revenues expected to be available to the region are dedicated funds that cannot be moved from one transportation spending category to another. For instance, state highway revenues cannot be spent on transit, and transit sales tax revenues are not available for use on the state highway system. Revenues received by local governments are also primarily limited to spending on one type of transportation or another. For example, local government state transportation aid is limited to roadway capital and operations. The existing county transportation sales tax and local property tax revenues offer local governments some flexibility in spending across modes.

Figure 3.3: Regional sales and use tax revenue allocations

The funding increases and changes provided by the 2023 legislature largely continue the practice of identifying in law the funding for specific purposes and transportation types. For instance, 83% of the new regional transportation sales and use tax goes to the Met Council, of which 95% is for transit and 5% is to support walking, biking, and rolling (active transportation). The new regional sales tax funding provided to metro area counties and to all local governments through the delivery fee and dedication of auto parts sales tax revenue does offer some flexibility for local transportation spending, though the legislation requires a specific distribution among various high-level spending purposes. Transit operators and county governments are the primary beneficiaries of the new transportation revenues. Funding needs remain particularly at the city and township levels as these local governments received relatively small revenue increases as part of the 2023 legislation. This plan provides guidance for, but does not direct, local government transportation spending priorities.

Walking, biking, and rolling (active transportation) in the region, in particular, will benefit from the county share of the newly created Transportation Advancement Account, which directed that 41.5% of the newly available county funds must be spent on active transportation (walking, biking, and rolling) and corridor safety studies. This represents a significant increase for bicycle and pedestrian transportation spending – transportation types that previously relied heavily on local general funds, spending as part of roadway projects, and federal Regional Solicitation funds. Now for county investments, these modes have a source of dedicated funding similar to roadways and transit.

The revenue assumptions for this plan include participation and input from staff at MnDOT, Metro Transit, other transit providers, and local governments. Where possible, they are based on existing financial resources, reports, and documents. MnDOT provided revenue estimates for state transportation revenue sources, expected metro district allocation assumptions, and expected transportation state-aid revenues for local governments. The Met Council and Metro Transit provided long-range transit revenue and spending estimates, and we used state auditor reports and data to estimate local transportation revenues and spending.

MnDOT metro state highway revenues

The MnDOT metro district’s estimated state highway revenues are shown in Table 3.2, below. MnDOT estimated the metro district’s total revenues at about $807 million in 2025 and almost $33 billion from 2025 to 2050.

| Revenue | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| Highway user taxes | $589 | 73% | $23,900 | 73% |

| Federal | $218 | 27% | $8,800 | 27% |

| Subtotal | $807 million | 100% | $32.7 billion | 100% |

MnDOT’s metro district uses metro state highway revenues to build, maintain, and operate the state highway system in the metropolitan region. These highways, often called trunk highways, include most of the region’s highways classified as principal arterials, typically four- to six-lane freeways and expressways, and around 20% of roadways that are classified as minor arterials, typically busy, two-and four-lane, signalized roadway corridors. MnDOT metro’s spending on these highways can also include some spending for transit, bicycle, and pedestrian improvements that happen within the highway corridor.

MnDOT’s primary sources of revenue for state highways are state highway user taxes and federal revenues designated from the Highway Trust Fund, primarily funded by federal fuel taxes. About every five years, MnDOT develops and updates its 20-year highway revenue and spending plan, the Minnesota State Highway Investment Plan (MnSHIP). In 2023, MnDOT led a large-scale effort to update the plan (previously updated in 2017) and MnDOT leadership adopted the new version in January 2024. The MnDOT metro state highway revenues and spending described in this plan are based on the draft 2024 MnSHIP revenues and spending estimates that were available in fall 2023.

State highway user tax revenues

State highway user tax revenues

Minnesota‘s highway revenues come from the state fuel tax, vehicle registration tax, and up to 60% of the motor vehicle sales tax. These sources are constitutionally dedicated to highway projects and are collectively referred to as highway user tax revenues. The Minnesota Constitution provides that 5% of highway revenues can be determined by the legislature for spending on the state or nonstate-aid highway network, and the remaining highway user tax revenues are then divided 62% to state highways, 29% to county state-aid roads, and 9% to city state-aid streets. MnDOT is responsible for tracking the highway user tax revenues and forecasting revenue into the future. In predicting future highway user tax revenues, MnDOT considers factors that could affect tax collections. These include factors such as improvements to vehicle fuel efficiency, increases in the purchase of and cost of electric and hybrid vehicles, leveling of per capita vehicle miles traveled, and national forecasts and expectations of vehicle costs and purchases.

The 2023 state legislative tax changes to the state’s highway user revenues result in a forecasted average 3.4% year-over-year increase in highway revenues and represent a 17% increase in estimated state highway revenues over previous revenue estimates over the life of the plan. In 2025, MnDOT forecasts total state highway revenues of $1.8 billion, of which 9% is for the Minnesota State Patrol and public safety, and 17% is allocated to debt service for previous state highway bonds. The forecasts estimate that more than $1.5 billion will be available for state highway capital and operating purposes in 2025, and this amount is expected to grow to more than $3.8 billion annually by 2050.

In its previous MnSHIP update, MnDOT anticipated that fuel tax collections would slightly decrease, averaging -0.7% annually. However, 2023 legislation increased the state fuel tax annually by the rate of inflation for construction costs while limiting the maximum annual increase of the fuel tax to 3%. This new provision will provide for year-over-year growth in the state’s fuel tax collections estimated at 3% annually over the life of this plan.

The 2023 transportation legislation also provided for an increase in vehicle registration tax revenues by increasing the vehicle registration tax rate, making changes in the vehicle depreciation schedule, and implementing a $75 annual registration tax for electric vehicles. These changes will result in increased revenues, and MnDOT now assumes a year-over-year increase in registration tax revenues of 4.5% annually.

Two other changes in the 2023 legislation also resulted in increased highway user tax revenues. The highway users fund receives 60% of the state’s motor vehicle sales tax (MVST) revenues. The sales tax rate applied to vehicle purchases was increased from 6.5% to 6.875%, providing for an almost 6% baseline increase in the MVST revenues. In addition, MnDOT assumes a 4.5% annual year-over-year increase in MVST revenue collections.

Under state statute, the highway user funds received a 43.5% share of the sales tax on auto parts, which would otherwise have been deposited in the general fund. The 2023 transportation legislation continues this dedication to the highway user fund, while dedicating the remaining 56.5% of the auto parts sales tax revenues to other local government transportation purposes phased in over a 10-year period, as described under the local government transportation section.

Federal revenues

Federal revenues

The other major source of revenue for state highways are federal transportation revenues generated through a federal fuel tax and primarily distributed through formula distributions to state departments of transportation, transit providers, and metropolitan regions. The federal transportation law that governs the distribution of the federal transportation revenues is typically updated and passed every five years. In November 2021, Congress and President Biden agreed to a new federal transportation law, the Infrastructure Investment and Jobs Act or IIJA, also referred to as the Bipartisan Infrastructure Law or BIL. The $1.2 trillion IIJA will be the governing law over all federal transportation policy and funding through 2026.

The amount allocated under the IIJA for highways represents a 90% increase over highway funding available under the previous federal bill, the FAST Act. The IIJA provided significant increases to highway funds available to states through established federal distribution formulas and created many new competitive grant programs for all surface transportation with billions of dollars available through these opportunities.

Federal formula funds

In 2025, MnDOT will receive around $715 million through federal formula programs, growing to almost $1 billion annually by 2050. MnDOT receives federal formula funds for state highways through five primary formula programs, as follows:

- National Highway Performance Program provides 53% of the state’s federal formula funds. This is the primary funding source for pavement and bridge repair and maintenance on the national highway system, which represents a majority of the principal arterial highways in the metro area. National highway performance funds can be flexed to transportation purposes off the National Highway System provided state performance targets for National Highway System pavement and bridge condition set annually by MnDOT are being met. National Highway Performance Program funds increased by 26% under IIJA.

- Surface Transportation Block Grant Program is a block grant program that can be used flexibly across transportation modes. About 10% of the surface transportation program funds must be distributed to transportation alternatives programs, like bicycle and pedestrian, that promote alternatives to driving. Surface transportation program funding is shared 45% to MnDOT districts and 55% to metropolitan planning organizations and local governments (see Regional Solicitation section). IIJA increased surface transportation program funding by 35% over the previous federal FAST act.

- Highway Safety Improvement Program is a formula program available for a variety of projects that address roadway safety problems. MnDOT shares these funds with local governments and the region typically receives about $30 million for distribution every two years. In the metro area the local, competitive highway safety improvement projects are approved by the Met Council’s Transportation Advisory Board and allocated through the Regional Solicitation process along with the region’s federal funds.

- National Highway Freight Program accounts for about 3% of the formula funds received by the state. This program is aimed at addressing safety and mobility issues for freight movement. MnDOT chooses to distribute these funds through a competitive state program. The metro region has been successful in receiving between 70% and 80% of these competitive funds.

- A new bridge program was created under IIJA designed to repair bridges both on the National Highway System and for off-system bridges owned by counties, cities, and townships. MnDOT shares these new bridge funds 50% with local governments for distribution. The metro area distributes these funds along with its share of surface transportation and highway safety improvement and funds through the Regional Solicitation.

Federal competitive funds

Over the six-year life of the IIJA, the federal government will award about $200 billion (31%) of the $643 billion available to states, metropolitan planning organizations, local governments, and Tribal governments through competitive grant programs. Some of these grant programs existed under previous federal bills, such as the RAISE grant program, while many others are newly created funding opportunities like the Reconnecting Communities grant program. Unlike formula funds, which are allocated using factors like population and miles of highways, grant program funds are allocated using program criteria established by the U.S. Department of Transportation that focus on how projects will perform in priority areas including safety, climate resilience, vehicle and infrastructure electrification, or equity.

Of the $200 billion available through competitive programs, about $100 billion is for allocation through the Federal Highway Administration. Some of the larger competitive programs available for state highway projects include the Bridge Investment Program and the Safe Streets for All program that focuses on making roadways safe for people.

These competitive funding programs offer many opportunities for the region to address topics and issues identified in this plan as regional priorities. MnDOT has developed a matrix for state highway projects to identify the important features of the proposed project and match it up against federal programs where it could most successfully compete.

For the purposes of developing long-range financial estimates, only competitive funding that has been awarded is assumed to be available and is shown for projects that are, or soon will be, under construction. For example, the I-494 E-ZPass project described in the Highway Investment chapter received a $60 million grant through the Nationally Significant Multimodal Freight and Highway Projects program in 2021 and a further $138 million grant through the Infrastructure for Rebuilding America (INFRA) program in 2024. However, these competitive federal funds offer significant opportunities to increase available metro area funding and specifically address our region’s goals. The Met Council and MnDOT will work closely together to identify new funding opportunities for state highways and compete in these important funding programs.

MnDOT metro district share of state and federal funds

MnDOT metro district share of state and federal funds

A new funding share of 43.5% of capital funds to the metro district goes into effect for MnDOT’s capital funds distribution in calendar year 2028 and forward. This is a significant increase over the metro district’s past share of statewide revenues, which ranged from 35% to 42% over the past decade. In 2028, the metro district estimates its share of state and federal highway funding will be about $600 million for roadway capital and is forecasted to grow to almost $1.4 billion annually by 2050.

The metro district also receives 26% of the state highway funding available for planning, operations, and maintenance. These funds are distributed primarily based on system size, such as number of highway miles. In 2028, $897 million will be available statewide for operations and the metro district estimates its share of these funds at $233 million, growing to about $450 million annually by 2050.

As shown in Table 3.2, the state and federal funds available for MnDOT’s state highway capital and operations in the metro area total about $807 million in 2025 and will grow to over $1.8 billion annually by 2050 when including expected inflationary increases. For the entire plan period of 2025-2050, almost $33 billion will be available for investment in the region’s state highway system.

Over the past decade, MnDOT metro district received its share of state and federal funding through both a district target formula and through pavement and bridge preservation allocations. This allocation method focused funds on maintaining system performance, and primarily used system size and usage factors to distribute the funding statewide. System needs more heavily represented in the metro area like mobility and safety, and roadside infrastructure preservation like water management, culverts, traffic management technology, and noise walls were not included in this fund allocation. Because of this focus on pavement preservation, the metro district’s share of state highway funds decreased over time, from around 44% of statewide funds in the early 2000s to allocations of 35% to 39% of the statewide highway funding in the more recent years.

In 2023, MnDOT convened a statewide committee to review the state funding allocations and made recommendations to MnDOT leadership about how to allocate available state and federal highway funding to the eight MnDOT districts. This group concluded its work in the summer of 2023 and forwarded a recommendation that included allocating both the statewide bridge and pavement performance funding and the district funding through one formula. They also recommended that the metro district share of statewide funding be established at 43.5% of the available capital funds given that the metro district has 56% of the state’s population, 61% of the state’s employment, and 67% of the state’s gross domestic product (GDP), including the vast majority of the state’s projected growth in these areas. Some smaller specialized funding sources like the state share of highway safety improvement funding will be set aside and distributed through different funding formulas. MnDOT leadership is still considering the committee recommendations and may determine to set aside additional funding for major pavement and bridge projects before distributing funding to the districts.

Regional transit revenues

The regional transit revenues are shown in Table 3.3 below. The estimated total regional transit revenues are about $1.7 billion in 2025 and around $54 billion from 2025 to 2050.

| Revenue | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| Regional sales tax | $449 | 27% | $17,300 | 32% |

| Motor vehicle sales tax | $368 | 22% | $14,300 | 27% |

| State general fund and bonds | $163 | 10% | $7,050 | 13% |

| Fares | $82 | 5% | $4,100 | 8% |

| Federal formula and Regional Solicitation through 2029 | $198 | 12% | $5,500 | 10% |

| Federal capital investment grants (New Starts) | $100 | 6% | $1,300 | 2% |

| County sales tax and regional rail authorities (for capital investment grant projects) | $244 | 15% | $1,050 | 2% |

| Regional transit capital property tax and other | $63 | 4% | $2,450 | 4% |

| Fund balance and interest earned | - | - | $850 | 2% |

| Subtotal | $1.67 billion | 100% | $53.9 billion | 100% |

Regional transit revenues include all revenues used by regional transit providers – Metro Transit, Met Council contracted services, Metro Mobility, and the suburban transit providers – to operate, maintain and build the region’s bus and transitway systems. Transit receives revenues through a variety of sources, with about 50% of the funding provided through two major taxes – the new regional transportation sales and use tax and the state motor vehicles sales tax.

In the past, bus operations have been funded primarily using motor vehicle sales tax revenues, fares, and other small amounts of available revenues. Light rail transitway operations, as required under previous state law, were funded using fares and the net remaining costs were shared equally by county transportation sales tax funds and state revenues. The new regional sales tax described below will provide an important new source of funding for bus and transitway operations and fill previously identified operating funding shortfalls. In addition, the 2023 state legislation now requires the Met Council to pay all transitway operating costs (after accounting for fares, federal, and any state revenues) using the new regional sales tax revenues. This requirement will shift over $3.5 billion of transitway operating costs from the metro counties to the Met Council using the new sales tax funds.

For transit capital, two revenue sources provide the majority of the revenues. The sources are federal formula funds received through the Federal Transit Administration and Met Council bonds known as regional transit capital, where the debt service is paid by property taxes levied in the statutorily defined transit capital levy district. Additional capital funding sources for specific projects include state general obligation bond proceeds allocated for arterial bus rapid transit construction, and federal capital investment grants and county transportation sales tax revenues used for dedicated light rail and bus rapid transit transitway construction purposes. Additional federal revenues have been included from the regionally allocated revenues for future arterial bus rapid transit projects based on funding allocation decisions through 2029.

New regional transportation sales and use tax

The 2023 legislature and Gov. Tim Walz took a very significant action by creating a new ¾-cent regional transportation sales and use tax. These revenues are shared 83% to the Met Council and 17% to metro area counties for transportation (see Local Government Transportation Revenues). The Met Council’s share is further divided 95% to regional transit and 5% to be allocated by the Transportation Advisory Board for active transportation purposes (walking, biking, and rolling). This new revenue will fill a significant funding gap previously forecasted in the region’s transit operating and capital budgets and will provide significant new revenues to fund new opportunities like bus electrification, increased transit services, safety initiatives, and micro transit. The funding available for new opportunities is discussed more in Regional Transportation Spending.

In 2025, the new sales tax revenues are forecasted at almost $450 million, accounting for 27% of total revenues, the largest revenue source for regional transit. These revenues are conservatively forecasted to grow at 3% annually and this inflation rate will be revisited once there is a stronger history of collections. At the 3% inflationary rate, total sales tax revenues for transit over the 26-year period of the plan are more than $17 billion.

Transit motor vehicle sales tax revenue

The state constitution dedicates the state’s motor vehicles sales tax revenues to transportation and requires at least 40% of these revenues to be allocated to transit. Prior to 2023, state statute dedicated 36% of the motor vehicle sales tax to metro region transit and 4% to transit in greater Minnesota (80 nonmetro counties in the state). As part of the 2023 transportation funding legislation, this proportion was changed to a new split of 34.3% of the revenues to the metro region’s transit and 5.7% to MnDOT for greater Minnesota transit. This changed distribution recognizes that the sales tax rate for motor vehicles had increased from the past 6.5% rate to a new rate of 6.875% and was meant to provide a similar level of revenue to the metro region as in the past, while also providing increased revenue for greater Minnesota transit needs. The change also recognized, in part, that the metro region’s transit would receive significant new revenues through the new regional transportation sales and use tax.

This plan uses the state’s February 2023 forecast as the basis for estimating transit revenues from the motor vehicle sales tax and uses an inflationary rate of 3% to grow these revenues over the period of the plan. Transit revenues from the motor vehicle sales tax are used primarily for transit operations but can also be used for transit capital. Reliance on motor vehicle sales tax revenues can provide some financial risk as major purchases, such as for motor vehicles, fluctuate with economic conditions. More vehicles and more expensive vehicles are purchased in good economic times, while fewer are purchased in less favorable economic circumstances. This annual fluctuation in expected revenues has caused some budgeting problems for transit over the past decades in years where motor vehicle sales tax did not perform as forecasted.

In the past, motor vehicle sales tax revenues comprised more than 65% of regional bus operating revenues and 27% of total capital and operating revenues available for transit. During the COVID-19 pandemic, as fare revenues fell dramatically, the reliance on motor vehicle sales tax revenues for transit operations increased even further. However, with the implementation of the new regional transportation sales and use tax, the motor vehicle sales tax will no longer represent transit’s major revenue source. In 2025, motor vehicle sales tax revenues for transit are estimated at $368 million or about 22% of the total transit revenues. Over the life of the plan, 2025-2050, motor vehicle sales tax revenues for transit are estimated to grow at 3% annually and provide $14.3 billion or about 27% of total transit revenues.

State general fund and bond revenues for transit

The state has historically provided a general fund appropriation for transit operations. The general fund revenues have historically been allocated to fund 50% of the after-fare costs of operating light rail transit and to fund Metro Mobility operating costs. Over time, the general fund appropriations have not kept pace with the growing costs for these two funding needs, and for most of the past decade the Minnesota Legislature has provided a flat appropriation of around $89 million annually.

In 2021, in recognition of the growing costs of Metro Mobility, the legislature passed a law specifying that Metro Mobility costs would be covered by the state through what is known as a forecasted program. As a forecasted program, the costs of Metro Mobility will be fully supported by the state’s general fund based on actual ridership and related capital and operating funding needs. This forecasted program funding will begin in state fiscal year 2026 (July of calendar year 2025). In addition, the 2023 transportation legislation removed the requirement that the state provide 50% of the operating costs for light rail.

As a result of these two legislative actions, this plan assumes the state will continue to provide the existing base general fund appropriation for light rail operations of about $33 million annually, but that this appropriation will not grow. For Metro Mobility, the general fund revenue will cover the capital and operating costs and will be required to grow at about the same rate of Metro Mobility ridership growth. The general fund revenues necessary for Metro Mobility total $115 million in 2026, the first year of the state forecasted program, and under an approximate 4.7% growth rate, increase to just over $400 million annually by 2050.

The state has also historically received state bond revenues for arterial bus rapid transit capital costs. Past state bond appropriations have varied with the specific cost of the arterial bus rapid transit line’s cost, typically ranging from about $50 million to $100 million for each line. This plan assumes the state bonds will continue to be available for five additional arterial bus rapid transit lines (METRO G, H, J, K, and L) that Metro Transit will implement in the first decade of the plan (2025-2034), totaling $320 million in state bond revenues.

Transit fare revenue

Transit fare revenues are the user fees received from riders using the transit system and are typically budgeted for transit operating purposes. Prior to the COVID-19 pandemic, fare revenues provided around 22% of systemwide operating costs. However, ridership and fare revenues during the COVID-19 pandemic dropped to historically low levels, falling in 2020 to under 50% of pre-pandemic ridership numbers. Ridership and fare revenues have been recovering and at the end of 2023, Metro Transit’s regular-route services were at approximately 60% of 2019 pre-pandemic levels.

This plan assumes ridership and fare revenues will continue to recover over time, and it forecasts that by 2034, ridership and the associated fare revenue will again reach 2019 levels. After 2034, ridership and fare revenue for existing services are forecast to grow about 1% annually. In addition, the region periodically implements fare increases so that the system-wide fare recovery remains stable over time as a percent of the total system costs. This plan includes fare increases roughly every five years. Total transit fare revenues come in around $82 million in 2025 and are estimated at around $153 million in 2034, when the system is forecast to reach pre-pandemic ridership levels. Total fare revenues over the period of the plan 2025–2050 are estimated at $4.1 billion.

Federal transit revenues

Similar to state highway funding, regional transit receives both federal formula funds and competitive, or discretionary, federal grants under the IIJA federal transportation bill. The federal formula funds are distributed through the Federal Transit Administration, and in the metro area, the Met Council serves as the designated recipient of all Federal Transit Administration grants. Federal funds awarded to other transit providers or to local governments are passed through the Met Council as subrecipient grants.

There are three primary federal formula funding programs for transit: the Urbanized Area Formula Grants, also referred to as section 5307 funds; the State of Good Repair Grants or section 5337 funds; and the Bus and Bus Facilities Program or 5339 funds. These programs provide formula funds for the region to use for transit capital asset management and improvement, including fleet replacement. In 2025 the region’s federal transit formula funds are estimated at around $146 million, totaling $5.3 billion from 2025-2050.

Regional transit receives competitive funding through the federal Capital Investment Grants (section 5309) program for transitway capital. These awards are on a project-by-project basis as the projects are approved. Consistent with the projects identified in the Transit Investment Plan and with the region’s history and experience in receiving full funding grant agreements for major transitway projects, the transit financial plan includes capital investment grant funding for the remaining costs of the METRO Green Line extension and METRO Gold Line, and the full costs of the METRO Blue Line extension, METRO Purple Line, and the Riverview modern streetcar.

Transit also receives federal competitive funding through the Regional Solicitation. This financial plan assumes that through 2029, 30% of the solicitation funds are available for transit projects. This share has been approved by the Transportation Advisory Board through 2029. As described in the Regional Solicitation section, a major project to evaluate the solicitation structure and method of scoring, and awarding funds will take place in 2024-2025. This plan does not assume any distribution of the Regional Solicitation funding beyond 2029. When the Regional Solicitation policy decisions and design have been approved by the board for the 2026 solicitation, this plan will be amended to include an updated description of the solicitation and any financial adjustments needed.

Transit providers may also receive competitive grants through the many IIJA programs. This financial plan does not assume any federal competitive funding that is not yet awarded. These federal programs offer a significant opportunity to bring additional funding and new transit service and capital projects to the region. If funding is received for additional regionally significant transit projects, it will be amended into the plan as necessary.

Property tax, county sales tax, and other transit revenues

The Met Council levies a property tax to pay for the debt service on transit bonds known as regional transit capital. The Met Council can issue transit capital bonds only when authorized by the state legislature to do so. Typically, these bonds are authorized on an annual or biannual basis. The regional transit capital funds are used to pay the capital expenses of maintaining the existing system and to provide the 20% required match to federal formula and other competitive federal funds. The revenue forecasts in this plan assume bonding funds will continue to be authorized at the existing level (about $55 million in 2025) and will grow at a rate of 3% annually. Regional transit capital revenues are estimated at $2.1 billion from 2025 to 2050.

County regional railroad authorities are authorized to levy a property tax for the purpose of developing regional transitways. Counties also may implement up to a half cent sales tax for transportation purposes and these funds can be used for transitway development costs. Typically, counties pay the remaining capital costs of dedicated transitways after applying the federal New Starts program funding, around 50% of the costs. Counties use both regional railroad funds and county sales tax for the transitway capital costs. This plan assumes that these county funds will provide the amount needed to complete the METRO Green Line extension and METRO Gold Line, and to fund about 50% of the capital costs of the METRO Blue Line extension and METRO Purple Line. This revenue is estimated at $1.1 billion.

The Met Council also receives other revenue used for transit operations from sources including advertising, investment income, as well as revenue from Sherburne County and MnDOT to pay the Greater Minnesota share of operating the Northstar commuter rail. Other revenues are estimated at approximately $8 million annually and $350 million from 2025 to 2050.

Local government transportation revenues

Federal transportation planning regulations require the region’s long-range plan to account for all transportation revenues and spending expected in the region over the period of the plan. That includes federal revenues used by local units of government – counties, cities, townships – on local roads, bicycle, and pedestrian systems. The regional plan must also account for revenue and spending on regionally significant projects on the metropolitan highway system (such as projects that add capacity and interchange projects on minor and principal arterials).

Local governments own and operate a variety of roadways including local streets collectors, minor arterials, and a very few principal arterials. Because most local transportation spending does not involve federal funding or regionally significant projects, it generally is not covered in detail in the regional plan. Only total local revenues and spending estimates are included along with those local projects using federal funds or that are regionally significant projects, which are specifically listed in the Long-range Project List.

Local transportation revenues come from a variety of sources, including: county and city state-aid allocations from the state highway user tax revenues; federal revenues distributed through the Regional Solicitation and other competitive federal funding programs; county transportation sales tax; county wheelage tax revenues; or property taxes, special assessments, or fees allocated to transportation purposes by the local government. Beginning in 2024, a new Transportation Advancement Account created by the 2023 legislature will receive funds from 17% of the new regional transportation sales and use tax, revenues dedicated from the state sales tax on auto parts, and a new retail delivery fee. As shown in Table 4, local government transportation revenues will total more than $2 billion annually in 2025 and $80 billion from 2025 to 2050. These various revenue sources are further described below.

| Revenue | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| State aid (county and municipal) | $482 | 23% | $18,600 | 23% |

| Federal (including awarded Regional Solicitation through 2029) | $106 | 5% | $1,600 | 2% |

| County transportation sales tax | $336 | 16% | $13,000 | 16% |

| County wheelage tax | $42 | 2% | $1,250 | 2% |

| Property tax and other | $951 | 46% | $37,600 | 47% |

| Metropolitan Local Governments Transportation Advancement Account | $40 | 2% | $4,450 | 6% |

| Metropolitan Counties Regional Sales Tax | $97 | 5% | $3,750 | 5% |

| Subtotal | $2.05 billion | 100% | $80.1 billion | 100% |

County and city state-aid revenues

Both cities and counties receive highway user tax revenues based on a statutory formula that accounts for factors like lane mileage, construction needs, vehicle registrations, and population. State highway user taxes must be used on the designated county and municipal state-aid systems for capital or operating purposes. The local highway user tax revenue estimates in this plan are calculated from historical MnDOT state-aid allocation data, inflated annually at a rate of 3%, similar to the inflation rate used in MnSHIP for state highway user tax revenues. In addition, metro counties receive a special, legislatively designated, state-aid allocation from motor vehicle lease sales tax revenues, and from a portion of the 5% highway user revenues that can be legislatively allocated.

Similar to state highway revenues, state-aid revenues received a significant increase, estimated at 17%, from the fuel tax and registration tax increases implemented as part of the 2023 transportation law. Including these increases, 2025 highway user tax revenues estimated to be available for the metropolitan area county and municipal state-aid systems will be almost $500 million annually and will total almost $19 billion for local governments from 2025 to 2050. As shown in Table 3.4, state-aid revenues provide around 23% of the total transportation revenues for local governments.

Local government federal transportation revenue

The primary source of federal transportation revenue for local governments is through the Regional Solicitation, described later under the regional revenues section. Historically the majority (about 70%) of Regional Solicitation revenues have been allocated to local governments for spending on their local roadways, and bicycle and pedestrian systems, or on state highways within their jurisdictions that are priority projects for the local government. The local government federal revenues include allocation of federal Regional Solicitation funds to local governments through 2029 (after the conclusion of the 2024 solicitation). The solicitation will be undergoing an evaluation during 2024-2025 that will result in a restructuring and potentially different allocation of federal funds among spending categories. When the Regional Solicitation evaluation is complete, the new policies and assumptions regarding funding distribution will be amended into this plan.

Local governments also receive competitive transportation funds through other programs like the Highway Safety Improvement Program and the new federal bridge program. Local governments may also receive competitive federal funds for projects that are local priorities for completion and are part of MnDOT’s state highway system. Federal transportation revenues total only about 2% of the spending by local governments on their transportation system.

County transportation sales tax

In 2017, the metro region’s counties were allowed to begin levying up to a ½-cent sales tax for transportation – this tax replaced the sales tax previously levied by the joint metro Counties Transit Improvement Board for transitways. Currently Carver, Hennepin, Ramsey, Scott, and Washington counties levy a ½-cent sales tax, and Anoka and Dakota counties levy a ¼-cent sales tax.

These local sales tax revenues provide significant flexible transportation funding for the local roadway, transitway, and if the counties so choose, MnDOT’s state highway system, and bicycle and pedestrian projects. Projects must be identified for funding through resolutions passed by the county boards. This plan estimates that from 2025-2050 around $13 billion in county sales tax revenues will be available for transportation.

The 2023 transportation legislation removed a requirement that 50% of the net operating costs for light rail be paid using nonstate sources. These costs had historically been paid by counties using their transportation sales tax revenues. In addition, the Met Council had existing agreements with counties to pay 50% of the operating costs of other dedicated transitways. The 2023 legislation now requires that the Met Council, after accounting for fares and any available federal and state revenues, use new regional sales tax revenues to pay the costs of operating dedicated transitways. This legislative policy change resulted in a shift of the transitway operating expenses from counties using their transportation sales tax revenues to the Met Council. This shift in funding responsibilities provided metro counties with about an additional $110 million annually in 2030 (after the opening of the Green Line extension), and more than $3.5 billion over the period of this plan, allowing these transportation sales tax revenues to be used on different county transportation purposes.

County wheelage tax revenues

Under state law, counties can levy a wheelage tax of up to $20 per vehicle for roadways. This tax is collected by the state along with the vehicle registration taxes. Dakota, Scott, and Sherburne counties currently collect a $10 per vehicle fee and Carver, Hennepin, Ramsey, and Washington collect a $20 per vehicle fee. Anoka County does not collect a wheelage tax. The county wheelage tax revenues total around $43 million annually and $1.3 billion from 2025-2040, about 1.6% of local transportation spending.

Local property taxes and other revenues

Most local transportation revenue is provided through local property taxes, local assessments, fees, or other special revenues allocated by local governments for transportation. As shown in Table 3.4, about $38 billion, or about 47%, of the approximately $80 billion estimated to be available over the life of this plan for local transportation will come from local property taxes and other fees. The property tax data was calculated from information submitted by the local units of government to the state auditor and published annually. These reports include the annual reporting of designated transportation revenues, along with transportation operating and capital expenditures for each local unit of government.

Recognizing that these local transportation expenditures can vary significantly from year to year, a base-year for revenues and expenditures was established by averaging calendar years 2019 through 2021 and inflating the average at a rate of 3% annually over the plan period. The local property tax revenue amounts were calculated by subtracting the known revenue contributions from the transportation sales tax, wheelage tax, state-aid, and federal revenue from the known total local transportation spending.

New transportation advancement account revenues

The 2023 state transportation bill created new revenue sources for local governments that were particularly significant for metropolitan area county funding. The bill created a new Transportation Advancement Account that includes allocations specifically for metropolitan area counties, along with new distributions for all counties, large and small cities, and townships statewide that will be included with the state-aid allocations.

The Transportation Advancement Account receives revenues from two sources – a new retail delivery fee of 50 cents per retail delivery exceeding a value of $100, and a phased-in dedication over 10 years of revenues from the state sales tax on auto parts. The revenues from the retail delivery fee are estimated at approximately $62 million statewide in 2025 and grow at about 3% annually, totaling $2.4 billion from 2025-2050.

The revenues from the sales tax on auto parts are phased in beginning with 3.5% of the revenues dedicated to the Transportation Advancement Account in 2024 and growing to 56.5% of the revenues in the account by 2033. This phase-in provides growing revenues for local government transportation with total revenues starting at $17 million statewide in 2025 and growing to $241 million annually in total statewide revenues from the auto parts dedication at full phase-in in 2033.

The Transportation Advancement Account is allocated in statute as follows:

- 36% to the seven metro area counties

- 10% added to county state-aid distributions

- 15% added to city state-aid distributions

- 27% for small (under 5,000 population) cities that do not receive state-aid funds

- 11% added to township state-aid distributions

- 1% for grants to nonprofit entities supporting food delivery services

Based on the amounts for metro-area counties and existing state-aid formulas, the metro area will receive an estimated 51% of the new Transportation Advancement Account revenues. The metro area revenues from the Transportation Advancement Account to all metro area local governments total almost $4.5 billion from 2025 to 2050, or about 5.6% of total local government transportation revenue.

In addition to the statewide revenues allocated to the Transportation Advancement Account, the seven metro counties will receive 17% of the regional transportation sales tax revenues, with the remaining 83% allocated to the Met Council for transit and active transportation purposes. The new metro counties’ share of sales tax revenues total about $97 million in 2025 and are estimated at $3.7 billion from 2025 to 2050.

When these two sources are combined, metro counties will be receiving an estimated $245 million annually in new revenues in 2034, at full phase-in of the revenues. The sales tax revenues will be distributed among the counties – 50% each based on each county’s share of regional population and the state-aid needs formula. The 2023 legislation requires the metro counties to use this new revenue – 41.5% for active transportation ($102 million annually in 2034) and safety studies; 41.5% for roadway preservation ($102 million annually) without adding capacity; and 17% ($42 million annually) for transit, complete streets, or greenhouse gas mitigation activities.

Regionally allocated revenues

Under federal law, large metropolitan areas receive a share of the state’s federal formula funds for project selection through the designated metropolitan planning organization. In the Twin Cities region, the Met Council has served as the designated metropolitan planning organization since 1973. For decades, the Met Council has been aided in the distribution of its federal funds by the region’s Transportation Advisory Board (TAB). The board brings together representatives and perspectives from local governments, residents, and transportation interests to select projects for the region’s federal funds. Under a long-established agreement between the Met Council and TAB, TAB is responsible for designing the project selection process and recommending projects for funding to the Met Council. The Met Council can fully accept TAB’s recommendations or return them to TAB, asking for reconsideration of elements or aspects of the project selection recommendations.

The project selection process for the region’s federal funds is known as the Regional Solicitation. The Regional Solicitation funds are intended to help the region achieve the goals and objectives envisioned in this transportation plan, and to address transportation problems identified in local plans. The Regional Solicitation makes the connection to the regional plan by designing an application process and scoring system meant to emphasize and connect to the regional goals, objectives, policies, and actions in this plan to the application categories, policies, and scoring criteria in the Regional Solicitation.

The past six solicitations used application categories based on project type (such as strategic capacity and modernization) within overall categories including roadways, transit and travel demand management, and bicycle and pedestrian facilities. A unique projects category was added in 2020 to allow for projects that do not fit well into the other categories. The TAB also funds one-third of the Regional Travel Demand Model and Travel Behavior Inventory work because this is a regional program with benefits to many partners. Over the past decade, TAB has distributed the available regional federal funds approximately 55.5% to roadway projects, 30% to transit and travel demand management projects, and 14.5% to bicycle and pedestrian projects. Any individual solicitation distribution can vary from this based upon the funding priorities as determined by TAB. Unique projects have received $4 million.

The Regional Solicitation typically awards funds three to four years in advance of the expected project construction to allow time for detailed project development after the funding award. Following the 2024 solicitation, the region’s federal funds will have been awarded through calendar year 2029. The funding assumptions in this plan for 2025-2029 include these awarded projects in the revenue assumptions for transit and local government revenues. State highways typically have not received federal funding awards.

There are additional funds that have not yet been incorporated into the Regional Solicitation, including federal sources for Carbon Reduction Program and Promoting Resilient Operations for Transformative, Efficient, and Cost-saving Transportation Program, and the regional transportation sales and use active transportation (walking, biking, and rolling) funding. These funding sources and the project selection processes will be developed through the Regional Solicitation evaluation.

The sources of federal and regional funding for the solicitation are estimated at $150 million annually in 2030, and over $4 billion from 2025 to 2050, as shown in Table 3.5.

| Revenue | 2030 | 2030 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| Federal (surface transportation and congestion mitigation) | $112 | 75% | $2,850 | 71% |

| Federal carbon reduction | $7 | 5% | $170 | 4% |

| Federal (promoting resilient operations) | $4 | 2% | $90 | 2% |

| Regional sales tax for active transportation | $27 | 18% | $910 | 23% |

| Subtotal | $150 million | 100% | $4 billion | 100% |

Regional Solicitation evaluation

In 2012-2014, the Regional Solicitation underwent a large evaluation process and was significantly changed and redesigned to reflect the outcomes and goals in the newly adopted Thrive MSP 2040 and the 2040 Transportation Policy Plan. Over the years the Transportation Advisory Board (TAB) has also implemented additional changes, but the overall structure has essentially been in place for six solicitation rounds for federal funding. With the expected adoption of the regional 2050 plans, the region is again undertaking a major evaluation of the Regional Solicitation process.

The intent of this evaluation is to assure that the structure and design is closely tied to and meant to achieve the goals and objectives identified in the regional plans. The new regional plans specifically identify regional goals of safety, climate, equity and inclusion, natural system preservation, and a dynamic and resilient region as the priority goals for 2050. In addition, this policy plan identifies specific transportation objectives, policies, and actions to contribute towards achieving those regional goals.

The Regional Solicitation evaluation will happen over two years (2024-2025) and will develop a new solicitation design to be in place for a 2026 Regional Solicitation. That solicitation will award approximately $250 million for a two-year period using federal surface transportation, congestion management and air quality, carbon reduction, and promoting resilient operations program funds. In addition, the evaluation will determine how to distribute the approximately $25 million annually in new active transportation (walking, biking, and rolling) revenues and whether those regional funds should be distributed on the same application timeline as the federal funds, or potentially in an off-year solicitation that includes only the regional active transportation (walking, biking, and rolling) funds.

Regional federal revenue

The primary source of federal formula funds for the region are Surface Transportation Block Grant program funds. The state is required to distribute 55% of the Surface Transportation Block Grant funds it receives based upon population. The funding attributed to large metropolitan areas, those with populations of more than 200,000, must be allocated directly to the region’s metropolitan planning organization to determine its distribution. The amount of transportation block grant funding, including amounts set aside for transportation alternatives and bridge spending, estimated to be available to the Twin Cities region is about $78 million annually. Surface Transportation Block Grant funds are one of the most flexible sources of highway formula funding, and these funds can be spent on many modes and activities including transit, bicycle, and pedestrian projects.

MnDOT also provides the metro region with the state’s Congestion Mitigation and Air Quality funding. Congestion Management and Air Quality funding is allocated to the states and must be spent in areas that do not meet federal air quality performance standards. The metro region went into air quality attainment in 2022 (meaning the region meets federal air quality performance standards) and continues to receive the federal congestion mitigation funds. Congestion Mitigation and Air Quality funds must be spent on projects that can help the region maintain its air quality conformance status, typically traffic signal retiming, transit, bicycle, pedestrian, and travel demand management projects. The region is projected to receive an estimated $34 million annually from this source.

Together the Surface Transportation Block Grant and Congestion Mitigation and Air Quality funds total around $112 million annually for the region and are estimated at $2.9 billion from 2025-2050.

The IIJA created two new programs that distribute funds to the region, the Carbon Reduction Program and the Promoting Resilient Operations for Transformative, Efficient, and Cost-saving Transportation Program (promoting resilient operations). Carbon Reduction Program funds are directed to spending on activities that will reduce transportation’s contribution to climate change, including travel demand management activities, and vehicle electrification and public charging projects. The promoting resilient operations funds are for elements of projects that contribute to making transportation more resilient to the impacts of climate and natural hazards like extreme heat and flood events. The region is set to receive an estimated $7 million annually in carbon reduction funds and $4 million annually in promoting resilient operations funds.

In addition, while not directed under federal law, MnDOT has chosen to provide the region with a portion of the state’s Highway Safety Improvement Program funding. Highway safety program funding totals about $15 million annually. These funds are typically allocated to local governments at the same time as the region’s federal funds are distributed, though the program uses a separate application process administered by MnDOT’s metro district with scoring measures specific to safety projects.

Regional active transportation revenue

As mentioned previously, the 2023 transportation funding bill created a new ¾-cent regional transportation sales and use tax that is distributed 83% to the Met Council and 17% to the region’s seven counties. The Met Council share is then to be used 95% for transit and 5% is for the Transportation Advisory Board to fund active transportation (walking, biking, and rolling) projects. The 5% active transportation share of the sales tax is set to provide an estimated $24 million annually beginning in 2024. At a 3% annual growth rate, the sales tax revenues will provide nearly $1 billion for supporting walking, biking, and rolling from 2024 to 2050.

The Transportation Advisory Board determined that one of the first tasks of the Regional Solicitation evaluation will be to focus on regional active transportation (walking, biking, and rolling) funding and determine how these funds will be distributed. The evaluation will determine whether the two funding sources and application processes will follow the same timeline and happen at the same time (along with the Highway Safety Improvement Program application process) or will follow a separate timeline.

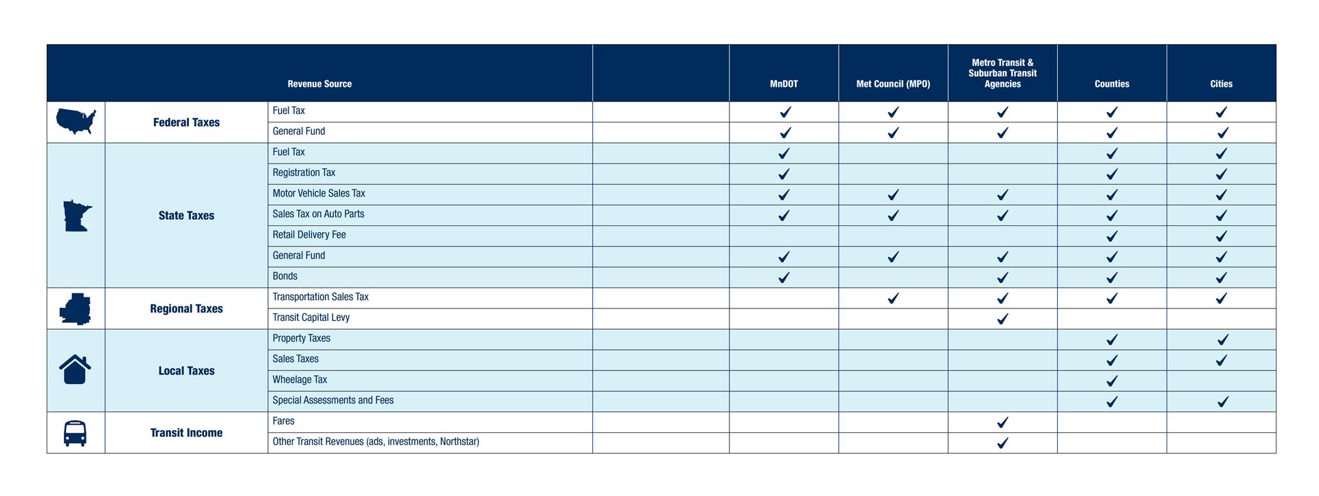

Table 3.6: Transportation revenue sources received, by government agency

Regional Transportation Spending

The following sections describe the high-level areas of spending for MnDOT metro state highways, regional transit, and local government transportation under the region’s fiscally constrained investment plan and reflect the estimated level of revenues previously described. Because the Regional Solicitation evaluation is ongoing and will determine the spending of the regional revenues among modes and activities, these amounts are not currently included in this spending description.

The total estimated spending, at over $171 billion, is shown in Table 6. The table summarizes the fiscally constrained spending for MnDOT metro state highways, regional transit, and local government transportation, broken into the general categories of transportation capital and operations spending, along with new transportation investment opportunities where the spending for revenues newly allocated by the 2023 legislation is not yet determined and there is opportunity to invest the revenue in new ways.

| Category | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| MnDOT metro state highways | $800 | 17% | $32,700 | 19% |

| Regional transit | $1,650 | 36% | $53,950 | 32% |

| Local government transportation | $2,050 | 44% | $80,150 | 47% |

| Regionally allocated funds | $150 | 3% | $4,050 | 2% |

| Total regional spending | $4.7 billion | 100% | $171 billion | 100% |

MnDOT metro state highways spending

MnDOT’s spending is broken into two broad categories: 1) highway capital spending and 2) planning, operations, and maintenance spending. After accounting for debt service costs, MnDOT generally has decided to allocate its remaining available statewide revenues approximately 62% to highway capital spending and 38% to planning, operations, and maintenance spending.

Highway capital spending generally includes construction activities or projects identified in a capital improvement program. MnDOT has both a four-year funded capital program, shown in the region’s adopted Transportation Improvement Program, and a 10-year capital highway investment program, which identifies planned capital projects for projects 5 to 10 years out. In 2025, MnDOT metro district has almost $600 million available for state highway capital spending, growing to almost $1.4 billion annually by 2050. Around $24 billion in total metro highway capital funding is available from 2025 to 2050.

MnDOT’s metro district’s capital spending is directed by the investment policies in the Minnesota State Highway Investment Plan (MnSHIP). MnSHIP establishes investment categories including pavement preservation, bridge preservation, roadside infrastructure preservation, transportation safety and advancing technology, highway mobility, freight, bicycle and pedestrian projects, local partnerships, main streets and urban pavements, and climate resilience. Funds are also identified for project delivery to invest the amount necessary to deliver the projects in the other categories. The detail on MnDOT metro district’s planned spending under these investment categories can be found in Regional Highway Investment Plan.

| Spending | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| State road construction | $594 | 74% | $24,500 | 75% |

| State road operations | $213 | 26% | $8,200 | 25% |

| Subtotal metro state highways | $807 million | 100% | $32.7 billion | 100% |

The high-level expectations for MnDOT’s spending over the period of MnSHIP and this plan are highlighted below. The metro district outcomes are expected in large part to follow MnSHIP’s expected outcomes except as noted below.

- MnDOT will meet all state and federal performance targets for pavement preservation, but overall, the condition of pavements will worsen with the statewide percentage of pavements in poor condition increasing.

- MnDOT will meet the federal performance target for bridge condition on National Highway System highways, but the condition of bridges on roadways not on the National Highway System will worsen.

- The condition of roadside infrastructure that currently does not meet performance targets will continue to worsen. This is particularly pronounced in the metro area, which has most of the state’s roadside infrastructure, including noise walls, culverts, lighting, and traffic signals. A higher percentage of the metro district’s spending is required for roadside infrastructure than is needed in the more rural districts.

- Spending on climate resilience will increase particularly due to new dedicated revenues through the federal program promoting resilient operations. New emphasis is being placed on addressing flooding risks and increasing green assets along state highways.

- Spending on safety will increase to address fatalities and serious injuries, which spiked during and after the COVID-19 pandemic.

- Spending on highway technology such as changeable message signs and other information technology will expand. Technology spending is particularly concentrated in the metro area, which continues to expand its regional technology infrastructure.

- Highway and freight mobility projects – like E-ZPass, interchanges, and targeted capacity expansions – will receive limited funding, about $85 million annually through 2033 in the metro area, at which time mobility project funding will be reduced to approximately $30 million annually. The vast majority of the state’s mobility project spending is in the metro area.

- Spending on pedestrian and bicycle improvements as part of state highway projects will increase, but still represents only about 3% of state highway capital spending. The region’s highway infrastructure will be compliant with current Americans with Disabilities Act (ADA) standards by 2037.

- MnDOT will continue its partnerships with local governments and provide some funding for local priorities on the state highway system. In addition, aging state highways that serve as main streets for local communities will be prioritized for pavement preservation projects and will include investments for projects with transportation choices. MnDOT funding for local governments' state highway project priorities is limited. In the metro area, Regional Solicitation federal funds can provide funding for these priorities on the state highway system.

MnDOT’s other primary area of highway spending is for planning, operations, and maintenance, including ongoing highway pavement and bridge maintenance, snowplowing, mowing and landscaping, and maintenance of roadside infrastructure, like traffic signals and other technology. The metro district receives 26% of the total revenues MnDOT has available for planning, operations, and maintenance activities. In 2025, the metro district’s spending on these activities will be $213 million, growing to about $450 million annually by 2050 and totaling $8.2 billion over this plan. For the metro district, planning, operations, and maintenance spending is approximately 25% of its total spending and highway capital spending comprises the remaining 75%.

Regional transit spending

The detail for planned regional transit spending under the fiscally constrained revenues can be found in Regional Transit Investment Plan. Regional transit spending is generally broken into operations and capital spending for both the regional bus and transitway systems. Table 8 shows the anticipated spending in each of these categories, along with the transitway spending showing a further breakdown of expected capital and operating spending on current transitways and new or expanded transitways. The high-level expectations for regional transit spending over the period of the plan are highlighted below.

| Spending | CY 2025 | 2025 % of total | 2025-2050 total | % of total |

|---|---|---|---|---|

| Bus operating | $684 | 41% | $28,650 | 53% |

| Bus capital | $250 | 15% | $6,250 | 12% |

| Current transitways operating | $143 | 9% | $5,200 | 10% |

| Current transitways capital | $468 | 28% | $3,400 | 6% |

| Expansion transitways operating | - | - | $5,550 | 10% |

| Expansion transitways capital | - | - | $2,650 | 5% |

| Remaining transit opportunity funds | $122 | 7% | $2,300 | 4% |

| Subtotal regional transit | $1.67 billion | 100% | $53.9 billion | 100% |

Bus operating and capital

- Prior to the 2023 legislative session, the regional transit system was facing significant operating and capital funding shortfalls. The new regional sales tax authorized by the 2023 legislature will allow the region to maintain its current operating levels for the bus and transitway systems, along with funding the system’s capital support needs, over the period of the plan.

- Bus operating expenses include spending on all existing bus operations including for Metro Transit, Metro Mobility, Transit Link, contracted services, and the suburban transit providers. Bus operations and capital spending represent the majority of current and future transit spending, accounting for about 56% of all costs in 2025 and increasing to 65% of all costs as new transitways are added over the period of the plan.

- This plan does not identify any significant expansion of existing bus services other than new arterial and dedicated bus rapid transit lines, which are included within the transitway expansion spending.

- The bus capital spending includes replacement of existing fleet under the regional fleet replacement policy and also maintaining and replacing other bus capital such as transit centers and bus stops. The funding does not include spending on bus electrification as identified under the Met Council’s zero-emission bus plans. It is estimated that about $1.3 billion in additional capital spending would be required to electrify the existing bus fleet.

- The remaining transit opportunity (sales tax) funds could provide funding for bus service expansion or bus electrification if identified as priorities for the region.

Transitway operating and capital

- The current transitways operating and capital spending includes spending for the METRO Blue and Green lines and Northstar commuter rail and comprises approximately 37% of total transit spending in 2025. (Operating and capital costs for the existing METRO Orange and Red lines and METRO A, C, and D arterial bus rapid transit lines are included within current bus operations.)

- Over the coming decades, about 6% of total spending will be required to maintain the current light rail system. Capital costs for the existing light rail lines will grow very significantly as the aging rail vehicles become due for replacement. About $1.1 billion of the total $3.4 billion of transitway capital spending will be for new rail vehicles, with an additional $600 million required for rail vehicle overhauls over the period of this plan.

- This plan identifies $8.2 billion in spending, about 15% of total spending, on transitway expansion operating and capital. The expansion transitways include the METRO Green Line extension, METRO Gold Line, METRO Blue Line extension, and METRO Purple Line dedicated transitways, along with the METRO B, E, F, G, and H arterial bus rapid transit lines.

New transit spending opportunities